Black Swan Business Setup Testimonial by Pawan Kumar Bansal Technical Services LLC

Starting a Business in Oman, like other GCC countries involves certain steps that need to be cleared appropriately. Let’s start by taking a look at the basic requirements before turning on to the specific processes.

Requirements to Register a Company in Oman

- A minimum capital requirement of OMR 150,000

- At least 2 Shareholders

- A registered office address

- One or more Directors of any nationality

Company Registration Process in Oman

The business ensemble is given a physical platform by the company formation process. The company Formation process involves certain steps which are to be followed for the incorporation and the post-incorporation process to set up a business entity in Oman.INCORPORATION PROCESS

-

Documentation

- Shareholders identity card

- Shareholders visa and passport

- Articles and memorandum for Association

- Tax Registration Certificate

- Certificates from Chamber of Commerce and Industry Affiliation

- Field company Registration form

- Initial deposit certificate

- Opening a Capital Account

-

Incorporation

- Approval from municipality

- Legalized opening forms

- Certificate of share capital

POST-INCORPORATION PROCESS

The post-incorporation process involves the following steps-

Application for Visa

-

Registration of Employees

-

Bank Account Conversion

- Salalah Free Zone Oman

- Oman Special Economic Zone of Duqm

- Oman Mainland Company Formation

- Company Formation in Oman

- Business Setup Service in Oman

Setup your Business Today!

Oman is a prime location and a future link between Asia and Africa. As such, starting a business here seems ideal, especially with the business-friendly atmosphere and the government’s initiatives in many sectors to bring in more investors.

To start a business in Oman, you should research thoroughly about the country, the city where you wish to operate and the viability of the business solution.

Start a new Business in Oman

Research on the type of company

There are three main types of business models that you can choose. You can start an LLC with a local investor as a sponsor, or you can start your company in a free-zone. You can also open a branch of a foreign company in Oman.Select location

Select the location of the business carefully. The site will impact footfalls, rent and sales. Free zones will give you more benefits on tax, but your business might be better suited to be in an area where you will get better traffic.Get your documentation ready

Make a Memorandum and Articles of Association, get all the required documentation ready, open a bank account, have the investors visa and gather other required permits.Reserve your company name

Ministry of Commerce and Industry operates under the Omani law and maintains a list of names for the business. Register your unique name with the MCI, according to the naming conventions of the Omani Law.Start the incorporation process

Once all your documentation is ready, submit the company opening forms, bank certificates and other necessary documents to the Ministry of Commerce and Industry for approval.Register with the Oman Chamber of commerce and Industry

Every business also needs to register itself with the Oman Chamber of Commerce and Industry (OCCI). They will give approval for your business to operate under the regulation of the Omani Law, and for compliance with commercial rules.Managing Bank account

You should open a bank account initially to deposit the capital for investment. This bank account can be later converted into a current account once your business get all the necessary permission to operate.Getting a visa for employees

Oman allows you to sponsor the visa for some of your employees to manage your business in the country. Make sure that the employee is registered under your business to get the visa. You will also be interested on:- Salalah Free Zone Oman

- Oman Special Economic Zone of Duqm

- Oman Mainland Company Formation

- Company Formation in Oman

- Business Setup Service in Oman

Setup your Business Today!

UAE Free Zones Cost, Time Frames, Renewal & Liquidation

For company formation, renting an office is mandatory. official business address cannot be designated to a private residence. Different types of offices are available which are subjected to the competent authority. workstations in an open-plan office of a business center, already fitted out offices or shell and core premises to warehouses with attached office space are various options. you cannot only rent commercial spaces but also buy them which is subject to the location of the company and the individual case.

UAE exhibits different ideas than the rest of the Middle East. They rely less on oil production, knowing they would run out someday. UAE imparts trades and merchants with startup opportunities and investment for UAE's booming entrepreneurship.

The United Arab Emirates is an ideal place to start your business. Based on the World Bank's Ease of Doing Business 2020 report, setting up a business in UAE is easier than in other Middle East countries. It takes only eight days and simple procedures to start a company in the UAE. Dubai is the best place for the UAE to invest because of its healthy business climate and abundance of resources. Dubai rulers are working hard to improve the business environment and provide opportunities for investors.

Best Businesses to do in Dubai

Construction

The construction of skyscrapers and high-rise buildings is not slowing down in Dubai. New buildings are erected with every passing day. Huge opportunities are open for architects, engineers, construction firms, real estate developers and various professionals of the sector. The investor can set up a real estate development firm or manufacturing business to sell materials used in construction.Handyman services

The handyman service business is in higher demand as people look for trusted agencies and skilled workers. Start the business with individual services of a small job for the clients. The working area of the handyman needs plumbing, maintenance, repair and other electrical jobs to offer different services to your clients.Beauty and Hair Salon

The residents of Dubai are conscious when it comes to beauty and fashion. Set up a ladies beauty salon in Dubai to provide services for beauty, hair, feet, nails and face. You must know the requirements of business and know Dubai's fashion trends.Real Estate Agents

The increasing number of expats increases the real estate affairs like selling, buying and renting of properties in Dubai. Residents have trustworthy agents to make property dealings. You must get advice from the consultancy agency and get the required licenses by authorities.Oil and Gas

The oil and gas industry of Dubai has operations like extraction, transportation, exploration and distribution that generates revenue for investors. The business startup needs thoughtful planning to start a business in the industry.Travel and Tourism

Opportunities for tourism includes business tourism, sports tourism, shopping tourism, medical tourism and cultural tourism. Other things related to tourism are food services, hotels, restaurants, transportation and photography. Travel and tourism emerges as a powerful industry with an annual economic impact of 6.5 trillion U.S dollars worldwide.Start a travel and tourism industry that makes profitable ventures for passionate entrepreneurs.Job Agencies

Many expats come to UAE in search of good job opportunities. Open a job providing agency in Dubai to connect companies and job seekers to use your channel. The Job Recruitment Agency Company can be started with ease and minimal investment.Webpreneur

Internet marketing, e-commerce, web development, mobile and online businesses are the trending sector for investments. E-commerce stores thrive more for businesses to go online. The digitization of the United Arab Emirates is growing and continues to provide more opportunities for webpreneurs.Online Tyre Trading Business

All prestigious car brands wander on the roads of Dubai. It gives rise to unique business opportunities for online tyre traders. The total worth of the tire market in UAE is valued at $ 220 million in 2019 and may cross $ 420 million by 2025. The Pioneer of the industry is PitStop Arabia, one of the leading online tire shops of Dubai.Business Consultancy Services

Business setup services and Business consultancy are the profitable business of Dubai. Get the license for the business from the authorities.Setup your Business Today!

The easiest way to get all the government work done without stepping out is through a UAE PASS.

The authorities state every individual to follow the necessary precautions when stepping out, stressing the message of 'Everyone is responsible'.

The authorities state every individual to follow the necessary precautions when stepping out, stressing the message of 'Everyone is responsible'.

People can access more than 5,000 government services by using a single username and password.

People can access more than 5,000 government services by using a single username and password.

The UAE PASS has the collaboration between Smart Dubai, Telecommunications Regulatory Authority (TRA) and Abu Dhabi Digital Authority and was launched in 2018.

The UAE residents and visitors can access government services and make regular payments such as home and mobile phone bills, which provides access to services like Dubai Now and for applying the residence visa or buying a property. This can be possible using the electronic signature.

The UAE PASS has the collaboration between Smart Dubai, Telecommunications Regulatory Authority (TRA) and Abu Dhabi Digital Authority and was launched in 2018.

The UAE residents and visitors can access government services and make regular payments such as home and mobile phone bills, which provides access to services like Dubai Now and for applying the residence visa or buying a property. This can be possible using the electronic signature.

The Advertising

UAE PASS comprises a single digital signature that would access more than 5,000 government services in the UAE.What documents are needed?

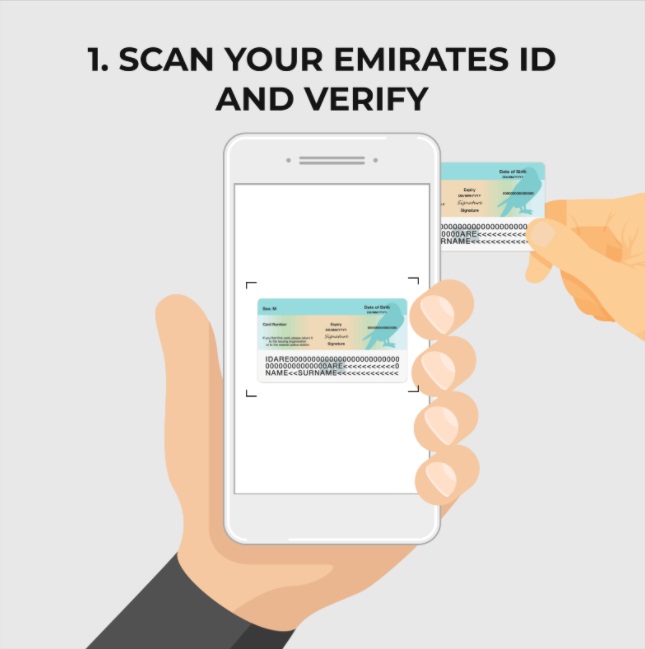

You only need your original Emirates ID.Can I apply online?

For the registration process, you can apply online and then the verification process is done at a kiosk, where you visit for the final physical verification.The process

The breakdown of the complete registration process:- You have to download the UAE PASS application on your phone.

- Then scan your Emirates ID, verify the information needed and set up a pin. This PIN is very much important, and you are advised not to share it with others.

- Opt to visit the UAE PASS kiosk near you to complete the final verification process.

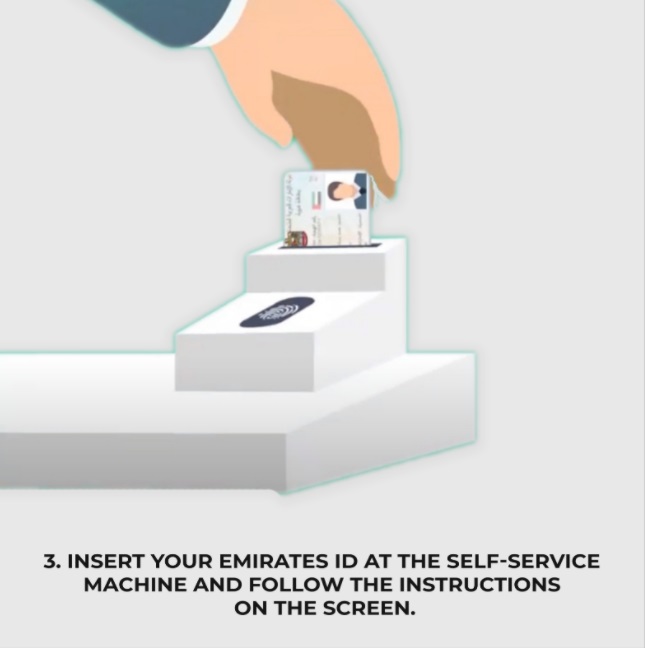

- Insertion of your Emirates ID at the self-service machine and following the instructions of the screen.

- Take a scan of your fingerprint.

The locations of UAE PASS kiosks

Dubai

- The Smart Dubai Government, Dubai Design District, 1A, 7th-floor reception area.

- The Dubai Economic Department offices (Dubai Mall branch, Al Barsha Mall, Al Twar centre)

- The Directorate Of residency And Foreigners Affairs -Al Jafilia

Abu Dhabi

- The Abu Dhabi Cooperative Society, Main Entrance

- The Abu Dhabi Cooperative Society, Dana Plaza Main Entrance

- The Deerfields Mall,2nd Floor, beside Carrefour, ATM Area.

Sharjah

- The Tasheel centre Sharjah Samnan, Ground Floor near main reception

- The KM Trading Shopping Centre, Main Entrance

- The Nesto Al Wafa General Trading, Main Entrance

- The Awqaf, Sahara Centre, Ground Floor beside Al Ansari Exchange

Ajman

- The Ajman Department of Economic Development, For Ground Floor Customer Service on Bashr Trade License

- The Ajman Markets & Co-operative Society - Entrance, The Main Entrance near the ATM area

- The Ajman Markets & Co-operative Society - Food Court, In-Ground Floor, Food Court Area near Tech Link Shop

Ras Al Khaimah

- The Ras Al Khaimah Department of Economic Development, Ground Floor Bashr Counter

- The RAK Mall, Main Entrance

- The Al Aswaq RAK National Markets, Main Entrance, near Dubai Islamic Bank ATM

- The Federal Electric & Water Authority (FEWA), Main entrance, right side

Fujairah

- The Fujairah Dibba Municipality, Ground Floor Customer Service for Bashr Trade License

- The Century Mall, Main Entrance, ATM Area

- The LuLu Hypermarket, LuLu Mall, Main entrance

- The Choithrams, Main Entrance, Baggage Counter Area

Umm Al Quwain

- The Carrefour Market, Main Entrance, near the cash counter

- The Federal Electric & Water Authority (FEWA), Main Gate, ATM Booth

- The LuLu Center, Main Entrance

Al-Ain

- The Al Foah Mall, Lulu Hypermarket, Ground Floor, Main Entrance inside ATM Booth

- The LuLu Hypermarket, Main Entrance

- The LuLu Hypermarket, Main Entrance

- The Al Ain Municipality, Main Entrance, Reception Area

Will I complete the services during COVID-19 related restrictions?

Based on Smart Dubai, people can still visit the UAE PASS kiosks to complete their registration process. Moreover, people are advised to stay home as much as possible and step out only for essential services. The authorities state every individual to follow the necessary precautions when stepping out, stressing the message of 'Everyone is responsible'.

The authorities state every individual to follow the necessary precautions when stepping out, stressing the message of 'Everyone is responsible'.

What services can I access now?

After downloading and registration, you can access over 5,000 different services that includes registering a business, paying your government bills, filing a complaint or sponsoring a visa.The UAE PASS

United Arab Emirates government’s long-term strategies like UAE Vision 2021 and UAE Centennial 2071, makes the UAE among the best countries in the world by the Golden Jubilee of the Union on six basic pillars. One of the six pillars, or national priorities, are to provide a sustainable environment and infrastructure. People can access more than 5,000 government services by using a single username and password.

People can access more than 5,000 government services by using a single username and password.

The difference between Dubai, Smart Pass and UAE PASS

The Dubai is exclusive for Dubai government-related services. But for Abu Dhabi and other emirates, residents can register for a Smart Pass. The UAE’s move towards providing integrated smart government services leading to the unification of these services under UAE PASS, which provides access to a range of government-related services, regardless of the Emirate you are in. The UAE PASS has the collaboration between Smart Dubai, Telecommunications Regulatory Authority (TRA) and Abu Dhabi Digital Authority and was launched in 2018.

The UAE residents and visitors can access government services and make regular payments such as home and mobile phone bills, which provides access to services like Dubai Now and for applying the residence visa or buying a property. This can be possible using the electronic signature.

The UAE PASS has the collaboration between Smart Dubai, Telecommunications Regulatory Authority (TRA) and Abu Dhabi Digital Authority and was launched in 2018.

The UAE residents and visitors can access government services and make regular payments such as home and mobile phone bills, which provides access to services like Dubai Now and for applying the residence visa or buying a property. This can be possible using the electronic signature.

The electronic signature

The UAE Pass provides users with an electronic signature, which is equivalent to you signing a document with a pen. The electronic signatures are legally valid under UAE law. Whether you are securing a new contract or making a big purchase, like a car or property, if you are using the UAE government’s smart services, you could use your UAE Pass signature. This is the first time digital signature solutions are provided in the region.Secure of my signature

The online services and UAE Pass signature are secured through several measures to provide a safe operating environment for users. The signatures are protected using the SHA-256 hashing algorithm.

The SHA-256

The SHA is- Standard Hashing Algorithm, was built by the National Security Agency (NSA) in the US. The SHA-256 is a ‘one-way cryptographic function’, which means that it cannot be decrypted back to the original text.Planning to Setup Business in Dubai?

Today’s corporate culture and modern lifestyle demands a well-groomed look. In UAE, many investors realize that beauty industry has much potential and are willing to invest in it. As the standard of living is going up, people are prioritizing their personal grooming and hence starting a salon business can do extremely well in the city. Opening a beauty salon in Dubai can be your key for a successful business.

Starting a Beauty Salon in Dubai - The process

A beauty salon in Dubai Mainland can be more profitable than in a free zone. Before starting any business, you should register with the Department of Economic Development (DED) as it is the regulatory body in Dubai Mainland and their steps include:- Submit the passport & visa copies of the investing partners.

- Decide the name of your beauty salon & submit it to the DED to get it approved

- After approval from the DED, draft and sign the Memorandum of Association or get it done by a Local Service Agent

- Rent a salon shop as per the requisite infrastructure standards of the DED and make an agreement with the tenant

- Obtain the tenancy contract along with the Ejari number

- Now you should get approval from the Dubai Municipality Planning Section

- Get approval from the Health and Safety Division of the Dubai Municipality

- Submit all the above documents to the DED and get your license

Beauty Salon in Dubai- Requirements for License & approval

- Approval of location by the Dubai Municipality planning department

- A sign board in front of the beauty salon

- Sufficient lighting, clean and proper furniture.

- Dressing chairs should meet the specific size of 3.0m wide x 3.5m length and strictly must not be less than that

- More than 2.30m height between the ceiling and the floor of the beauty salon

- Separate areas more than 2.50m x 1.50m with proper partition designated for beauty treatments like Pedicure, Manicure, Hair removal, and Henna design

- A wash basin near the area for facial treatments

- Preparation area for hair removing materials must be made of Fireproof materials

- A water heater

- Cupboards and drawers to keep cosmetics and towels

Types of Beauty Salon Licence in Dubai - UAE

Two types of Licence is available for beauty salons in Dubai - UAE Women's Beauty Salon Licence : It comes under Professional License type, The Activity group come under “Ladies Salon” and its activity code is 930203 Gents Salon Licence : It comes under Professional License type, The Activity group come under “Gents Salon” and its activity code is 930201 Not sure how to start your own beauty salon in Dubai? You can always get help from a professional consultant like Black Swan Business Setup Service LLC, a reputed name in company setup in Dubai. Our team will study your requirements and cater to your needs. Contact us today!NEED HELP ? GET FREE CONSULTATION TODAY !

A vital offshore jurisdiction providing wide range of business advantages to international investors eager to form companies in insular state is Seychelles. Among the different benefits offered, one that is worth the mention is privacy of the firm as well as share capital requirements, where in majority of the cases, is said not to exist. To understand better how offshore companies can be set up by foreigners in Seychelles, you can discuss with our Seychelles company formation specialist team.

To set up Seychelles company, what minimum share capital is required?

Registered Seychelles companies having 1 non-resident director and shareholder is not required to offer minimum share capital. When fees are concerned, the investor simply requires to take into consideration approximate $100 government tax. In Seychelles, a popularly formed business structure is International Business Company or IBC.

What maximum authorized capital is necessary in Seychelles?

When maximum authorized capital is concerned in Seychelles, no limitation exists. This means, IBC registration is possible even with an amount of $100 million. Our Seychelles company incorporation team can provide valuable information on how to form different available business structures or IBCs in Seychelles.What minimum share capital is required by LLCs in Seychelles?

Minimum share capital is not required by Limited Liability Companies (LLC) to resister its business in Seychelles. As a matter of fact, Seychelles LLCs can be owned by foreigners to about 100% and also not subjected to taxes on earnings.Benefits of Seychelles offshore companies Formation

The preferred business jurisdiction that offers innumerous benefits and welcoming business environment with regards to forming offshore companies in insular state is Seychelles. Given below are few benefits that foreign investors can enjoy by forming offshore companies in Seychelles:- No mandatory minimum share capital for Seychelles company.

- Such companies can derive tax-free benefits, which mean earnings are levied upon.

- Foreign investors are free to form companies in Seychelles enjoying 100 percent ownership.

- Seychelles offshore companies do benefit by deriving complete privacy with regards to assets and owners’ name.