How to form a Mainland Company in Oman

Before you move forward with Mainland Company Formation in Oman, you should know the basics about this legal entity. This article will give you a brief explanation of what a Mainland Company is, what kinds of licences can be given to a business, and what benefits you can expect from forming a Mainland company in Oman. After that, you can start the process of forming a company by working with a business expert. https://www.youtube.com/watch?v=Dwb1pn2nThgWhat is a Mainland Company?

What is an Oman Mainland Company? To put it another way, an onshore company has all the power it needs to do business. Oman is one of the best places to do business in the world. Both companies in a free zone and companies on the mainland can find opportunities there. To start a business in Oman, you will need to get different licences that give you permission to do different things in business. Being a foreigner is not as hard as you might think if you have a business in Oman. This is one of the benefits of having a business there. There are areas just for foreign investors, so you can be sure to get the help you need. And if you already have a business in Oman, you can grow it there. Then, you can start your business in a Free Zone in Oman, as long as you check the records of your previous businesses before giving them to the government. In Oman, there are two different kinds of joint-stock companies. Society Anonyme Omanaise (SAOG) is one type of joint-stock company, and the other is a private joint-stock company. An SAOG can be a private or public joint-stock company, which makes it perfect for people who don't want to raise money from the public. Both types of businesses need the same amount of money to start up.Types Of Business Entities In Oman

There are three types of business entities in Oman: general partnerships, limited liability companies, and sole proprietorships. Public alliances are made up of two or more entities, while one or two people make up a limited liability company. Many joint-stock companies are owned by the government of Oman. The most common type of business in Oman is a limited liability company. Every type of business entity has a lot of good points. Here are some things to think about when choosing the best one for you. Limited liability company: An LLC is a legal entity in which shareholders are only responsible for the number of shares they own. To set up an LLC in Oman, you need at least two shareholders. One must be from Oman, one from the GCC, and the other must be from the US. The minimum amount of share capital is 150,000 OMR. Oman's legal requirements also require you to have one director. The capital laws in Oman are pretty good for foreign investors. Commercial agency: As the name suggests, this type of business is a contract with an Omani agent to do business in Oman. Its goal is to sell products or services in Oman or to set up a business there. As part of the Royal Decree 55/90, the Commercial Code sets rules for commercial agents. In Oman, a commercial agent must have a representative who lives there.Types Of Licenses Issued In Oman

When setting up a mainland business in Oman, you need to get a lot of different licences. Branch offices are extensions of foreign parent companies and can do business that makes money. Representative offices, on the other hand, can only do marketing. The limited liability company is the most common type of company that people in Oman form on the mainland. You must get a trade licence from the Ministry of Commerce and Investment in order to start a business in Oman. Based on the civil law tradition, large parts of Oman's law can be interpreted in many different ways. The CL's General Provisions section starts with the history of a company and goes on to talk about its foundation and the different types of companies that are legal. It then talks about the different types of capital and corporate classes. Finally, it talks about how corporate law affects crimes.Benefits of Mainland Company Formation in Oman

Companies that are based on the mainland, also called "onshore" companies, can do business outside of their home area. The Sultanate of Oman has many options for starting a business on the mainland, such as free zones. Commitbiz is a service provider and mentor with a lot of experience who helps business owners get started and understand how the law works. If you want to start a business in Oman, you can get more information from Commitbiz. It helps people start their own businesses by giving them one-on-one mentoring and advice. Choosing the Omani Mainland has a lot of good points. One of these is how easy it is to use. After you register your business with the MOCI, you must send in the Rest paperwork. After you get your registration, the process can take anywhere from four to six weeks to finish. Because of this, Oman Legal Services helps investors with their paperwork and other formalities. Foreign investors don't have to worry about company paperwork and formalities. Instead, they can focus on their business. Another good thing about Mainland Company Formation in Oman is that it has many advantages. Besides being a free zone, it also has a number of tax benefits. For example, a local company will be able to apply for Oman tax residency, which will let it bid on lucrative government tenders. You can also benefit from the fact that the government spends so much money in Oman.Tax Exemptions in Oman

In many areas, foreign investors in Oman's Mainland don't have to pay taxes. You can also benefit from free trade zones and special land grants from the government. This country has shown that it can do business on a global scale, and its economy is one of the top twenty in the world. The Ministry of Commerce and Industry in Oman is always looking for new ways to help new businesses get started in the country. Here are some of the best tax benefits for forming a Mainland company in Oman. Salalah Free Zone : Al Mazunah Free Zone is a free zone in the southern part of the Sultanate of Oman. This area has the lowest prices for infrastructure, people, and utilities. You'll also get duty-free goods and tax breaks for 30 years. The country has good relationships with other nations and has spent USD 26 billion on building new infrastructure. Joint Stock Companies in Oman : A Joint Stock Company (JSC) is a business that doesn't have to have a minimum amount of paid-up share capital. In Oman, you can also start a Single Person Company (SPC) without any paid-up share capital. Public JSC and Private JSC are the two most important JSCs in Oman. To start a business in Oman, you need to pick the right type of SAOC.Documents Required for Company Formation in Oman

To start a business in Oman, you need to get the following papers ready. The fee for forming a company and the documents of the shareholders must be notarized. You'll also need to open a capital account to put the fees for forming a business into. You must also sign up with the Oman Chamber of Commerce and Industry if you want to follow business rules. In Oman, it takes about three weeks to sign up for something. Depending on the type of business you have, you may want to set up a limited liability company. A limited liability company (LLC) is a legal entity that can only do business in Oman. Oman needs a minimum of OMR 150,000 in capital, and a portion of this amount must be shown as proof of funds. An LLC can also be made by a single shareholder or an LLC. In Oman, you have to get a business licence. A company that is based on the Mainland is also called an onshore company. This kind of business can do business in places other than where it was founded. Free zones in Oman are a good choice for people who want to start their own businesses, but they should double-check their paperwork before giving it to the government. It would help if you always talked to a lawyer about your documents before sending them in. You can also get help from a local company that helps people start businesses. Send in all the necessary paperwork to start the process of incorporating. Here are the most important papers you will need to send in:- Memorandum of Association and Articles of Association

- Passports and Visas for Shareholders

- Certificate of Tax Registration

- Identification Card for Shareholders

- Certificate of initial deposit

- Filled Company Registration Form

- Certificate of Industry Affiliation and Chamber of Commerce

Mainland Company Registration Process in Oman

The process of registering a Mainland Company in Oman can be hard, but it is not impossible. Oman's growth is driven by international emigrants, the country's protected climate, and its free trade zones. The country has a moderate population. The Omani government is doing everything it can to help new businesses start up and help existing businesses grow. Companies in Oman can also take advantage of the country's safe climate, freehold properties, and high level of property rights security. In Oman, it's easy to start a business. You don't have to be physically in the country to start a business. You can even do it all online. Once you're registered with MOCI, you'll need to send in more paperwork, which can take between four and six weeks. You should use Oman Legal Services if you are not from Oman and want to focus on growing your business instead of taking care of paperwork. They will take care of all the paperwork and formalities so you can focus on running your business. After you get your business licence, you will need to get other permits. It takes a while for the Ministry of Commerce and Investment to answer. It is important to check the documents you use to register your business for mistakes and wrong information. Once your records are in order, you can give your LLC a name. Choose a name that shows what you want to do with your business. Make sure the name means something in the law. When setting up a business in Oman, there are a few important rules to follow.1. Decide on the Trade Name

The names of businesses must be unique and related to what they do. Please choose a name and send it to the Ministry of Commerce and Industry.2. Present documents of incorporation

Send in all the necessary paperwork to start the process of incorporating. Here are the most important papers you will need to send in:- Memorandum of Association and Articles of Association

- Passports and Visas for Shareholders

- Certificate of Tax Registration

- Identification Card for Shareholders

- Certificate of initial deposit

- Filled Company Registration Form

- Certificate of Industry Affiliation and Chamber of Commerce

3. Funds Account Opening

After the papers are turned in, Open a capital account to put the money for the first year of business in.Register with the Chamber of Commerce

Sign up with the Oman Chamber of Commerce and Industry to follow the rules and regulations for business in Oman.Register the Business

Below documents are to be submitted- Legalized Opening Forms

- Approval of Municipalities

- Certificate for Share Capital

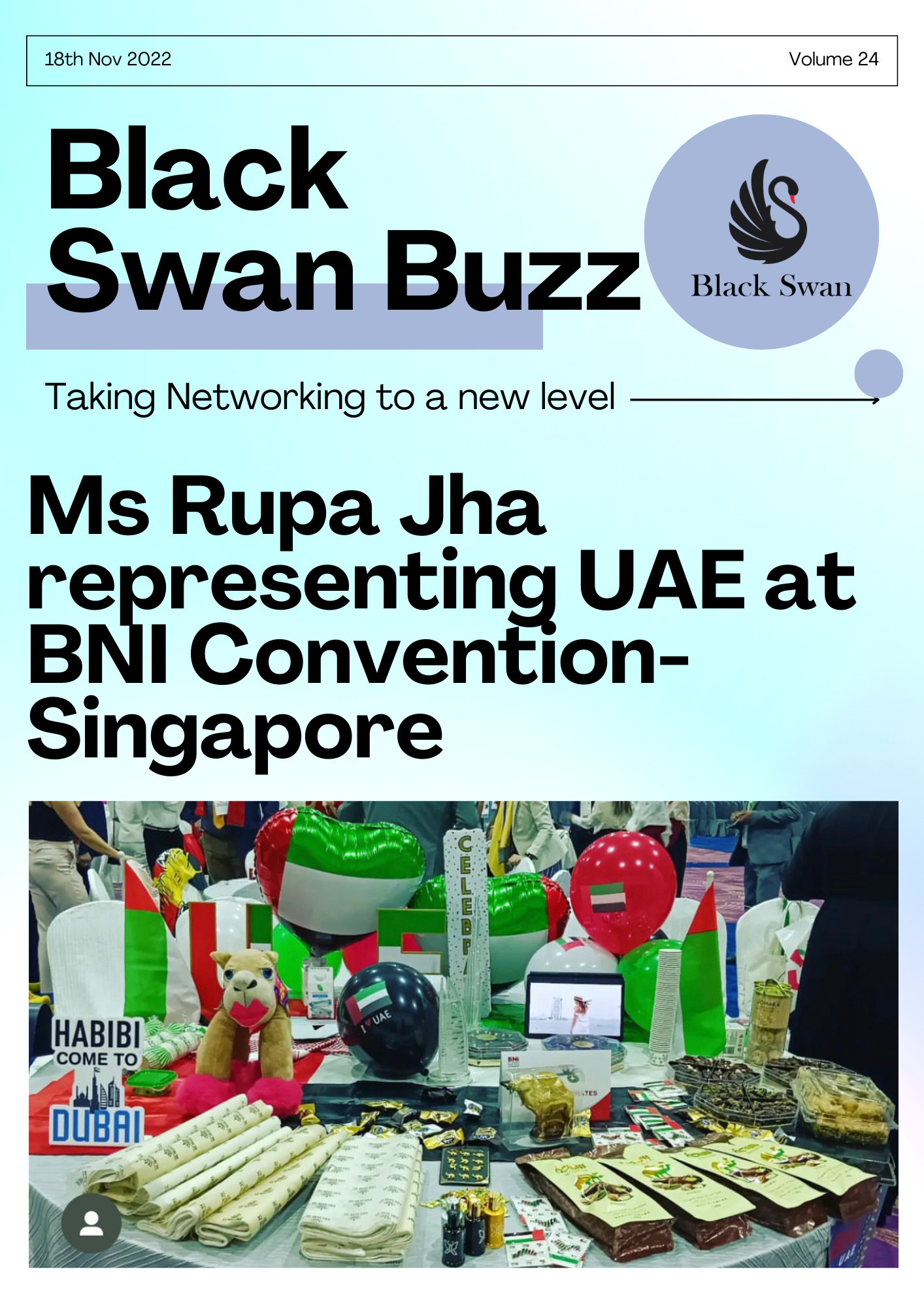

Why Blackswan ?

Blackswan Business Setup can help you in company incorporation process in oman and you can Open a Company in Dubai Mainland at an affordable cost. Tags: Business Setup Service Oman, Oman Mainland Company Formation, Company Formation in Oman, Company Registration in Oman, Oman Company Incorporation, Opening Branch Office in Oman, Oman Freezone Company Formation, Oman Free Zone Licence & Business Setup Cost, Sole proprietorship, Joint Stock Company, Representative Office, Salalah Free Zone, Al Mazunah Free Zone, company incorporation process in oman

When you start your own business in Dubai, one of the most important things to think about is what kind of business entity to choose. Most of the time, you can choose between the mainland, a free zone, or an offshore entity. Each has its own pros and cons, and the right choice will depend on what your company does for business, who it wants to trade with, how it is owned, and other factors.

So, how do the types of businesses compare? Which one will help your business the most? Our blog goes into detail about these questions and compares the costs, problems, and benefits of each place.

1. Free Zone Company

Free zones are places where goods and services can be bought and sold, usually with lower taxes and customs fees. By doing business in one of Dubai's 30 free zones, you can get benefits like 100% foreign ownership, 100% tax exemption for corporations, 100% repatriation and capital funds, and 100% repatriation and capital funds.

Ownership Structure

One of the best things about setting up your business in Dubai's free zones is that you have full ownership of it. To start a business, you don't need a local sponsor or service agent.

Business Activity

You can't do business on the mainland as a company in a free zone. If you want to sell to people in the UAE, you will need to set up a company on the mainland with the help of a local sponsor.

Office Requirements

In each free zone, there is a wide range of office space options, from virtual desks to offices and even flexi-desks.

Visa Requirements

The number of visas you can get will depend on the size of the office space you rent and the type of free zone you are in. Most free zones in Dubai will let you get between 3 and 6 visas.

At DMCC, the number of visas your business can get depends on the size of the office you choose:

- Flexi desk: up to 3 visas.

- Serviced office: 4 to 5 visas depending on the size of the office.

- Physical space: 1 visa for every 9 square meters.

Cost of Setup

Costs vary greatly for setting up and running a business in one of Dubai's free zones. Here is a list of the four main fees for setting up and running a business in Dubai:

- Company Registration Fee

- Licence Fee

- Office Fee

- Share Capital

For a more in-depth look at how the costs of setting up a business in Dubai's different free zones vary.

2. Mainland Company

Companies that are based on the mainland, which are often called "onshore" companies, have access to the local market and markets outside of the UAE. To become a Mainland LLC company, you must get a licence from the Department of Economic Development (DED) of the emirate where you want to do business.

Ownership Structure

Before the new UAE laws on commercial company ownership went into effect, foreign business owners who set up a mainland company in Dubai could only buy 49% of the company's shares. A local sponsor had to buy the other 51%. But as of December 1, 2020, the UAE passed a law that lets foreigners own 100% of companies on the mainland. Since the resolution is so new, it has not yet been fully put into place or fully explained.

Business Activity

A business that is based on the mainland can do business anywhere in the UAE. They can also do business in any free zone in the United Arab Emirates.

Office Requirements

In contrast to a free zone or an offshore company, mainland companies must have an office space. The DED says that you have to rent at least 200 square feet of office space. Companies on the mainland are not allowed to have virtual offices.

Visa Requirements

For a company on the mainland, there are no restrictions on visas. The size of rented office space or a business facility determines how many residency visas can be given. So, the more office space your company has, the more work visas your company may be able to get. In general, one visa per 80 square feet is used to figure it out.

Cost of Setup

When a business owner starts a mainland company, some of the first costs they can expect are:

- License fee: The DED has different licence options, but the standard trade or service licence is usually 5% of the rent. A General Trading licence Instant licence, Merchant licence, and launch licence don't apply to this.

- Initial Approval from DED

- Dubai Chamber of Commerce

- Approval of trade name

- Office rent

- Attestation of Memorandum of Association (MoA)

- Drafting of contract and court agreement attestation

- Registration with Ministry of Economy

- Trade license fee

- UAE local Sponsorship fees depend on the nature of the business

3. Offshore Company

Offshore companies are not allowed to run any kind of direct business in the UAE. But an offshore company can be a shareholder in any UAE company on the mainland or in a free zone. This lets the offshore company enter the UAE market and do business through its subsidiary companies.

Ownership Structure

An offshore company can own the whole business, but it can't have a physical location in the UAE.

Business Activity

An offshore company in Dubai can do business anywhere in the UAE, including on the mainland and in any of the free zones.

Office Requirements

A company that is not based in the UAE cannot have a physical office there. Their office must be in a country other than the one they work in.

Visa Requirements

Visas can't be given out by companies in other countries. Only companies in Dubai/UAE that are on the mainland or in a free zone can give out resident visas.

Cost of Setup

Setting up an offshore business isn't too expensive. Setting up an offshore company in Dubai is the least expensive of the three options. This is because there are no minimum requirements for capital deposits before incorporation, and there are no costs associated with office space or getting a visa.

Choosing the Right Jurisdiction for Your Business

Your company doesn't have a "best" choice between a free zone on the mainland or one off the coast. Whether or not a jurisdiction is good for your business depends on its goals and strategies.

Here is a summary of what was talked about in the blog.

|

|

Free Zone |

Mainland (Onshore) |

Offshore |

|

Ownership Structure |

100% foreign ownership |

100% foreign ownership |

100% foreign ownership |

|

Business Activity |

You can trade within the Free Zone and internationally. Trade within the UAE is possible through a local agent/distributor. |

You can trade throughout the UAE and internationally. |

They are free to do business outside the emirates. They cannot have a physical setup for doing business within the UAE. |

|

Office Requirements |

Not compulsory to have a physical office space. Many free zones in Dubai allow you to create a business licence by offering virtual/flexible desk solutions. |

Minimum 200 sq ft office. |

You are not allowed to have any physical office in Dubai. |

|

Visa Requirements |

Setting up your company in a Dubai free zone automatically makes you eligible for a visa. Visa costs differ per free zone. |

The number of residency visas granted is based on the size of leased office space. Generally, it is calculated as one visa per 80 square feet. |

No residency visas issues. |

|

Cost of Setup |

Medium-High Setup costs strongly depend on which free zone area you select. |

High |

Low |

Set Up Your Business in DMCC

If you think the best thing to do is set up as a free zone entity, DMCC is your best bet. As the world's number one free trade zone and the centre of global commodity trading, DMCC offers your business benefits and services that can't be found anywhere else to help it succeed

Tags: Company Formation Dubai, Company Registration Dubai, Dubai Freezone Company Formation, Dubai Mainland Company Formation, Offshore Company Formation, DMCC Company Registration, Difference Between Mainland Free Zone Company Formation

- Abu Dhabi Global Market (ADGM)

- Dubai Airport Free Zone (DAFZA)

- Dubai Multi-Commodities Center (DMCC)

What is Cryptocurrency?

The popularity of digital currencies is growing rapidly in the United Arab Emirates, creating a wealth of new and interesting business prospects in the fields of cryptocurrency exchanges, holding, and trading. One of the most popular discussions among aspiring business owners and investors is how to launch a bitcoin enterprise in Dubai, United Arab Emirates. Digital currencies, sometimes known as cryptocurrencies, are cryptographic tokens based on the widely publicised blockchain technology. When it comes to the value of cryptocurrencies, there is no one entity in charge of doing so. Instead, cryptocurrency is disseminated electronically among its users. Dogecoin, Bitcoin, and Ethereum are just a few examples of well-known cryptocurrencies that can be purchased and used right now. Cryptocurrencies are available for buying or mining on many decentralised exchanges. Despite cryptocurrency's outward appearance as an asset class, investing in it involves significant dangers. To fully grasp how the Bitcoin system works, you need have done adequate research. One would reasonably wonder, given the inherent dangers, how they have become such a popular trading method. The exponential growth of cryptocurrency prices is largely responsible for their widespread adoption. To a lesser extent, holders and traders of cryptocurrencies also utilise them for international money transfers.Requirements for Getting Cryptocurrency License in Dubai, UAE

The UAE government has instituted a few prerequisites for applying for a cryptocurrency licence in the Emirates, and these prerequisites are in place for regulatory purposes. The following are the necessities for getting a cryptocurrency licence in the UAE:- Obtain a commercial licence application from the DED

- Then, submit passport copies for any business associates.

- Your cryptocurrency wallet's transaction history should be spotless, with no indication of any fraudulent activity.

- After that, have a plan in place to show how much money the business has and how much it costs to run for the next six months.

- To legally hold any cryptocurrency in the United Arab Emirates, you must register your holdings with a "UAE financial free zone" department approved by the country's government.

- Submitting your complete business plan to the appropriate government agency is the final step.

How to Set Up a Crypto Business in Dubai

Follow the steps below and you'll be well on your way to launching a successful crypto business in Dubai, where there are many crypto aficionados and modern investors.- Choose a name for your business.

- Choose the economic zone you want.

- Register for a cryptocurrency licence by filling out an application.

- Follow all the rules and regulations

Choosing a Company Name

The first step is to choose a name for your business that doesn't include any well-known brands or swear words. The name of your business needs to be simple and easy to remember. Also, if you want someone's name to be your business's trademark, it should be that person's real name. There can't be any nicknames.Selecting a Preferred Jurisdiction

Next, you have to decide whether your crypto business will run in a UAE free zone or on the mainland. Both jurisdictions have their own advantages and disadvantages. One of the best things about free zones is that you can use any currency you want. You can also use the gain and income repatriation to your advantage. On the other hand, if you set up your business on the mainland, you can easily travel to all of the Emirates' states.Register for a Cryptocurrency License

After thinking about the above, you should be ready to sign up for a cryptocurrency licence in Dubai, UAE. You can also send this application straight to the appropriate government department. But it can be hard for an expatriate to take care of everything on their own. Because of this, the crypto business experts at the Riz and Mona Business Consultancy are a good choice to work with.Follow All the Compliance Regulations

In Dubai, both traditional financial trades and Bitcoin trades are supervised in the exact same way. Because of this, you should have the right licence and follow all the rules against money laundering. If you aren't careful at this step, it could hurt your business.Steps for Getting a cryptocurrency license in Dubai

- You can download and fill out an application form for a cryptocurrency licence from the government agency in Dubai where you want to set up your business.

- Put the name and name of each shareholder in your company on the form and send it in.

- Give all of the required documents to the government agency where you are setting up your business.

- Pay the application fees to the government agency that is in charge of giving you a licence to deal in cryptocurrency.

- If the application form and the company's official legal documents are all in order, the authorities will give you a cryptocurrency business licence within a week.

Incorporate Crypto trading company in Dubai

Where to Get the Cryptocurrency License in Dubai

You should get a cryptocurrency licence in the UAE before starting a cryptocurrency business in Dubai. At the moment, three of the free zones across the country are giving out licences for cryptocurrency.- Abu Dhabi Global Market (ADGM)

- Dubai Airport Free Zone (DAFZA)

- Dubai Multi-Commodities Center (DMCC)

Cryptocurrency License in Dubai Multi-Commodities Centre (DMCC)

The DMCC is very open to the idea of adding and introducing cryptocurrency. They give licences to new business owners and entrepreneurs in Dubai who want to use cryptocurrency. People from all over the world come to DMCC in the Emirates to get a licence to trade in cryptocurrency. With a DMCC cryptocurrency licence in Dubai, you can do business activities like providing services related to cryptocurrencies, trading, storing cryptocurrencies, managing them, making apps and software related to cryptocurrencies, and much more. With a cryptocurrency licence in the city, you can also offer consulting and other services. DMCC has opened a new centre for cryptocurrency and wants it to be the hub for all blockchain-related activities in Dubai. Dubai is already known as the most technologically advanced city in the world, and the addition of new technologies like blockchain and crypto-only made its position even stronger. The DMCC cryptocurrency licence is a veryCryptocurrency License in Dubai Airport Free Zone Authority (DAFZA)

Dubai Airport Free Zone Authority is what DAFZA stands for. This is another free DMCC in Dubai that accepted cryptocurrencies without any trouble. They made a deal with the ESCA (The UAE Securities and Commodities Authority) that helped them help new businesspeople and entrepreneurs who wanted to do great things with crypto for their businesses. By giving cryptocurrency licences to businesses in Dubai, they made it possible for them to do business. By getting a cryptocurrency licence from the DAFZA, companies can use crypto assets for different business activities. Also, they can help foreign investors from all over the world who come to Dubai to do business. The DAFZA has a strong regulatory framework that makes it easy for companies to do business within its borders. They are moving forward with their plan to make digital currencies like Dogecoin, Bitcoin, Ethereum, etc. grow and be used more.Cryptocurrency Licence from Abu Dhabi Global Market (ADGM)

Abu Dhabi Global Market lets crypto assets that are regulated by the Financial Services Regulatory Authority (FSRA) work (ADGM). FSRA is the regulatory body that handles all cryptocurrency-related assets in the Emirates. At the moment, it is the only legal government body in the UAE with a large framework for regulating crypto licences. ADGM and FRSA have put out a guide for how cryptocurrency licences can be used in the country, which will help both small and large businesses in the Emirates. Tags : Professional License Dubai, Business Incorporation Dubai, Business Setup Dubai, Company Formation Dubai, Company Registration Dubai, Dubai Freezone Company Formation, Dubai Mainland Company Formation, Get Cryptocurrency License in Dubai, Get Cryptocurrency Trading License in Dubai

Types of logistics business activities that can be licensed in the UAE

- Freight broker

- Customs broker

- Warehouse storage

- Leasing

- Air cargo transportation

- Sea cargo transportation

- Land cargo transportation

- Fleet management

UAE governmental authorities responsible for providing specific licenses for logistics business

- Dubai Customs

- Dubai Police

- General Civil Aviation Authority

- Maritime Authority

- Roads and Transport Authority

- Food Control Department

- Ministry of Climate Change

- Civil Defence

What is a logistics Licence in Dubai?

In Dubai, a logistics licence is just a permit that lets you run a legal logistics business from the emirate. This licence is for a wide range of logistics businesses, such as freight and customs brokers, warehousing companies, logistics planning firms, companies that move cargo by sea and air, and many more. If you're not sure if your business needs a logistics licence in Dubai, our experts can help you figure it out.Benefits of opening a logistics company in Dubai

As one of the most important shipping hubs in the world, this emirate is a great place to start a logistics business. Some of the most important benefits are:Location

Dubai is in a very important place on the map of the world. A lot of trade takes place on sea and air routes that go through Dubai. The emirate is a centre for trade between Asia, Africa, Europe, Australasia, and, to a lesser extent, the Americas.Great tax benefits

If you start a logistics business in Dubai, you can take advantage of the very low corporate and income taxes in the emirate. Also, if you choose to run your business from a free zone, you might not have to pay any corporate tax or VAT at all.World class infrastructure

Most people agree that Dubai's sea ports and airports are some of the best in the world. Thanks to this great infrastructure, it will be easy and smooth for you to start trading.A government that supports trade

The government of Dubai is pro-market and pro-business, and it works to make the emirate a fair and competitive place to start a logistics business.Proximity to other logistics companies

In Dubai, there are a lot of logistics companies, and each one specialises in a different area. This means that there are a lot of possible business partners, suppliers, customers, and skilled workers near your logistics company. All of this makes it easier and more efficient to run your business than if it were in a place where the industry isn't as well-developed.Global trade agreements

Dubai and the United Arab Emirates as a whole have many trade agreements with countries all over the world. This means it will be easy for you to do business with people everywhere.Steps to start a logistics company in Dubai

In 2022-23, here are the steps you will need to take to get your logistics licence in Dubai:1. Choose a company name

First, you have to come up with a name for your business. The name of your business should reflect what it does best, and it should also follow the UAE's rules for business names.2. Choose between mainland or a free zone

You can run your business from the mainland of Dubai. This is a good choice if you plan to work directly with partners in the emirate.3. Apply for a logistics licence

You must fill out an application form for your business and send it along with certain documents to the Department for Economic Development (on the mainland) or the free zone's authorities. The whole thing can be done online, and it only takes a few hours.4. Submit all required documents

When you apply for a logistics business licence, you must provide a number of documents. Creative Zone can help you through the process if you don't know which documents are needed or what format they should be in:- An application form

- A copy of your passport

- If you are an expat and want to live on the Dubai mainland, a copy of

- the passport of your local sponsor.

- An Emirates ID copy

- Your memorandum of association

5. Logistics licence will be issued

Most of the time, the logistics licence will be given to you in just a few days, at which point you can start your business.6. Start processing visas

Many people who own logistics businesses hire foreign workers. If this is part of your business plan, all of your foreign employees will also need to apply for visas. At Creative Zone, we can help you figure out how to get visas for your employees. Tags : Professional License Dubai, Business Incorporation Dubai, Business Setup Dubai, Company Formation Dubai, Company Registration Dubai, Dubai Freezone Company Formation, Dubai Mainland Company Formation, Real Estate Business / Company Registration Process, Start / Setup / Open a Licensed Play School, UAE Short and Long-Term Residency

Oman Emerging business hub in the GCC

In the Sultanate of Oman, the majority of the economy's revenue comes from the oil and petroleum industry. The government of Oman, on the other hand, has been concentrating on the new possibilities presented by the worldwide digitization of society. Oman is one of the most exciting places for a self-employed person or a multi-millionaire to set up shop. Forming a company in Oman is a great first step to take if you have a business idea and are trying to expand your horizons. Investors from other countries perceive the location as a great opportunity to make a lot of money.Business Registration Process in Oman

There is a link between a few key elements of the Oman corporate register. To register, complete these simple steps:Choose a Business Model

When deciding how to incorporate a company in Oman, an investor must consider the amount of capital available as well as the number of stockholders. An investor has the following options:- Sole proprietorship

- General partnership

- Limited partnership

- Joint Stock Company

- Holding Company

- Branch Office

- Representative Office

Reserve your Business Name

The company's name is also its identity, so keep that in mind. So, what do you think of when I say the names Amazon and Pepsi ? Isn't it just a store and a Coke bottle? And now here you are, reading this very piece of writing. Yet an instantaneous mental picture appeared upon hearing the brand name. Choosing a business name is more complicated than it first appears. First and foremost, you should make sure that your business name stands out from the crowd. And you need to watch out that the company's moniker doesn't offend anyone's sensibilities by making fun of religion. Contact us to Register your Business NameChoose the Best Location

In order to be successful, a business must be established in an area with a sizable population of its target demographic. At the same time, it's important to make sure the investors' first investment requirements are met. In Oman, there are special economic zones where businesses can put their money where it will go the farthest. If an existing firm already operating in UAE or UK wants to expand its operations, it can do so by setting up a subsidiary on the Mainland. However, Oman's Free Zones are the most practical option for would-be business owners because to their low overhead. Contact us for Business Space, Virtual Office and Office Spaces in OmanDocuments Required setting up of business in Oman

When you've settled on a name for your company, it's time to get it officially registered. Some of the most vital records are as follows:- A complete application form

- Shareholder Agreements and Other Constitutive Documents

- The Articles of Organization and Memorandum of Association

- Tax residency certificate

- Initial Deposit Receipt

- Validation of Membership in a Chamber of Commerce or an equivalent document

Submit the Oman Chamber of Commerce and Industry (OCI) with the Company Essentials.

Obtaining a business licence in Oman is another crucial step. Make sure you join the Oman Chamber of Commerce and Industry to ensure you're in line with regulations (OCCI).Create a Capital Savings Account

An organisation can't function without having a corporate account to handle money transfers and other financial dealings. Rather than randomly picking a bank, a business should first investigate the different options available to it. In order to deposit the initial fee for forming a company, you must first open a capital account.Obtain a Business Seal

Letterhead with a company's official seal displays the company's official signature. This is crucial when dealing with company shareholders since it prevents falsification of the most important business documents.Post-Incorporation Process

A few extra actions are required after you have registered your firm. Here are just a few examples:Recruit the Best Working Staff:

Organizations in Oman can legally recruit from anywhere in the globe, offering you access to the most qualified candidates. It is important to foresee the company's demands and draw up a departmental structure before making any hires. Understanding the current requirements will allow you to take the necessary next steps.Complete the Visa Application Process

The next step, after finding the proper employees for your organisation, is to help them obtain work visas. An employment visa will be issued to the successful applicants, while an investor or employer visa will be required.Employees Registration

When a person accepts a position with a company, they become legally considered an employee of that company. It's crucial to think about getting them registered under the business's name.Bank Account Conversion

Finally, the original capital account is updated to the current version to ensure the seamless running of the business.Why Choose BlackSwan for Business setup in Oman

Black swan can help you in entire business setup service in Oman, Fill up the form below or call us for a free consultation. Tags: Business Setup Service Oman, Oman Mainland Company Formation, Company Formation in Oman, Company Registration in Oman, Oman Company Incorporation, Opening Branch Office in Oman, Oman Freezone Company Formation, Oman Free Zone Licence & Business Setup Cost, Sole proprietorship, Joint Stock Company, Holding Company, Representative Office

Since a number of years, Dubai's real estate sector has expanded at a rapid rate. In addition, in 2022, new regulations will permit more foreign investors to purchase real estate in the emirate. This indicates that inquiries about real estate in Dubai are increasing at an unprecedented rate, making now an excellent time to launch a real estate business.

Benefits of starting a real estate company in Dubai

Dubai's real estate market is one of the most desirable in the world due to its sustained growth over many years. Among the primary advantages of launching a real estate firm in Dubai are:

- The Dubai real estate market continues to generate impressive returns for investors, with yearly yields of 5% or more being the norm.

- Dubai's real estate market is broad and diverse, offering investment opportunities in residential, commercial, student housing, luxury property, hotels, and industrial units, among others.

- Transparent regulations: Dubai's legal system is well-respected and transparent, so you can invest with confidence.

- The Dubai real estate market is very competitive and available to investment by anyone, including foreign investors.

- With its educated, competent, and professional population, you can be confident that houses for sale or rent will be in great demand.

How to get a Real Estate Business licence in Dubai

If you intend to become a real estate agent in Dubai, you must finish real estate professional certification training. Four days of training will provide you with a comprehensive overview of all you need to know to legally work as a real estate agent in Dubai. After finishing a training course, you must pass a test administered by Dubai's (RERA). You will be able to apply for an agent's licence upon completing the exam.

RERA licence cost

The price of an RERA licence depends on the applicant's prior academic level. If you have a bachelor's degree, the examination price is AED 3,200. It costs AED 6,300 for those without a bachelor's degree.

In addition to exam expenses, you must additionally account for the cost of completing an RERA training course. These items normally cost between 2,500 and 3,500 AED.

Steps to start a real estate business in Dubai

Dubai's Department of Economic Development (DED) outlines various requirements for launching a real estate company in Dubai. When you work with Black Swan, we will guide you through the six steps outlined below.

Select a trading name

When selecting a company name, it should reflect your primary business operations. For example, AJ Shah Real Estate LLC is an appropriate name.

Additionally, the UAE has severe regulations regarding the language and phrases used in corporate names. You may not use any rude, insulting, or profane language.

Decide on a jurisdiction

In Dubai, there are three economic jurisdictions where real estate companies can establish a presence: the mainland, the free zone, and the offshore. Each of these has its own distinct business regulations, advantages, and disadvantages. When choosing your jurisdiction, you must evaluate the type of your business, the accessibility of your target market, and the location of your office. At Black Swan, we can advise you on the jurisdiction that best fits your circumstances.

Legal structure

You must also determine the legal structure of your firm, as different structures are more or less suitable for various sorts of enterprises. The following are some of the most frequent types of legal structures for real estate companies in Dubai:

- Sole establishment

- Limited liability company (LLC)

- Free zone company

- Foreign company branch

Submit your documentation

Depending on the form and location of your firm, you must submit a variety of paperwork when applying to start a real estate business in Dubai. At Black Swan, we can advise you on the precise documents you want and verify their accuracy:

- The DED registration application form

- A copy of your passport

- A copy of your Emirates ID

- A certified copy of your office lease

- The RERA licence

Approval process for special activities

If your real estate company needs to engage in specialised operations (such as real estate construction), you may need permission from other relevant authorities. Black Swan can provide particular guidance.

Process your UAE visa

If you (or your employees) are not Dubai citizens, you may need to apply for visas for your staff and family members at the same times as your visa application. The process is as follows:

- Getting an entry permit

- Changing your status

- Taking a medical exam

- Getting your Emirates ID

Cost of starting a real estate company in Dubai

The price of launching a real estate business in Dubai is between AED 10,000 and AED 30,000. (in addition to your RERA licence). Fees will vary based on a number of variables, such as your location, office startup costs, and whether you choose to operate from a Dubai free zone, a mainland firm, or an offshore company. In general, beginning costs are lower if your business is located in a Dubai free zone.

Working with Black Swan

Black Swan Business Setup can help you in Setting up of real estate business in Dubai At an affordable cost

Tags : Real Estate Business Setup Dubai, Real Estate Business Setup Dubai UAE, How Start Real Estate Business Dubai UAE, How Get Real Estate License Start Real Estate business, Make Top Virtual Destination Investing Dubai Real Estate , Steps to Start Real Estate Agency in Dubai, Professional License Dubai, Business Incorporation Dubai, Business Setup Dubai, Company Formation Dubai, Company Registration Dubai, Dubai Freezone Company Formation, Dubai Mainland Company Formation

UAE Residence Visas

The UAE government has released new visas that give people more options for both short-term and long-term stays. This makes the UAE an even more appealing place for expats from all over the world. The new visas are part of the most important changes the UAE has ever made to immigration and residency. Check out the options for visas, how long they are good for, and what you need to get one. Look for Investment Opportunity Visa With this short-term visa, investors can visit UAE for up to 60, 90, or 120 days without a sponsor or host on a single-entry visa. This visa makes it easier for people to visit the UAE and help it become a place where investors want to do business.Job Opportunities Visa

The Job Opportunity Visa gives people time to look at different job opportunities and find the right one to help them advance in their careers. You can get this visa for 60, 90, or 120 days. To get a Job Opportunities Visa without a sponsor or host, you must meet the following requirements:- The Ministry of Human Resources and Emiratization says that candidates must be at the first, second, or third skill level.

- Have a Bachelor's, Master's, or PhD from a university in the UAE that is recognised by the Ministry of Education.

- A new graduate from one of the top 100 universities in the world

Multiple Entry Long Term Tourist Visa (Valid for 5 years)

Families of people who live in the UAE can get a Tourist Visa with Multiple Entries and a Long Stay. The visa is good for 5 years, and the person who gets it can stay in the country for up to 90 days at a time. They can stay longer, but not for more than 180 days in a year. Before applying, the applicant should have at least $4,000 or the foreign currency equivalent in their bank account.Mission Visa

Experts can get a Mission Visa, which is a work permit that lets them come to the UAE to work in a UAE-based organisation for a short-term project. When applying for the visa, the worker must be outside of the country. The Ministry of Labour will send a letter to the UAE-based company asking them to sign it. The letter will explain the employee's job, salary, and professional title. The visa for the Mission is good for 90 days.Green Visa

The newest visa is the Green Visa for the UAE. It is meant to make it easier for people in all kinds of jobs to move to the UAE. Investors, business partners, skilled employees, and people who work for themselves or as freelancers can use it. The Green Visa can be used for 5 years. After 5 years, it can be kept going.What are the requirements to obtain a Green Visa?

-

Freelancer/ Self-employed

-

Skilled Employee

-

Investor/ Partner

Golden Visa

The goal of the UAE Golden Visa is to help both people and the economy of the UAE. The visa lets people live in the UAE for a long time and gives them great benefits and incentives. It also helps the UAE economy by attracting and keeping investments and the most skilled workers.Various categories can obtain a Golden Visa including:

-

Golden Visa for Investors

-

Golden Visa for Skilled Workers

-

Golden Visa for Entrepreneurs

-

Golden Visa for Specialized Talent

-

Golden Visa for Outstanding students and graduates

What are some of the advantages of the new visas available in the UAE?

- The UAE is known as a place where people from all over the world come to do business. These new visas offer more incentives to individuals, start-ups, SMEs, and multinational companies. They also encourage people to stay in UAE for a long time and bring in the best talent.

- If there are more options for residency, it will encourage more foreign investment, which will make the UAE's economy richer in more industries.

- There are more options for families travelling to the UAE. Residents can now travel to UAE with their families for up to 180 days per year on a tourist visa that is good for 5 years and allows multiple entries.